hccf.ru Overview

Overview

Olli Stock Price

View Ollie's Bargain Outlet Holdings Inc OLLI stock quote prices, financial information, real-time forecasts, and company news from CNN. Ollie's Bargain Outlet Holdings Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time OLLI stock price. The average price target is $ with a high forecast of $ and a low forecast of $ Price targets go from $64 to $ The majority of stock analysts believe OLLI is a buy. Please note analyst price targets are not guaranteed and could be. Get Ollie's Bargain Outlet Holdings Inc (hccf.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. Ollie's Bargain Outlet offers a wide selection of discounted household goods, apparel, pet supplies, kitchen pantry staples, and seasonal products. OLLI (Common Stock). Price, , Change, Volume, ,, % Change, %. Intraday High, , 52 Week High, Ollie's Bargain Outlet Holdings is a discount retail chain with more than stores throughout the eastern US and more than 9 million customers. Ollie's Bargain Outlet Holdings Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - View Ollie's Bargain Outlet Holdings Inc OLLI stock quote prices, financial information, real-time forecasts, and company news from CNN. Ollie's Bargain Outlet Holdings Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time OLLI stock price. The average price target is $ with a high forecast of $ and a low forecast of $ Price targets go from $64 to $ The majority of stock analysts believe OLLI is a buy. Please note analyst price targets are not guaranteed and could be. Get Ollie's Bargain Outlet Holdings Inc (hccf.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. Ollie's Bargain Outlet offers a wide selection of discounted household goods, apparel, pet supplies, kitchen pantry staples, and seasonal products. OLLI (Common Stock). Price, , Change, Volume, ,, % Change, %. Intraday High, , 52 Week High, Ollie's Bargain Outlet Holdings is a discount retail chain with more than stores throughout the eastern US and more than 9 million customers. Ollie's Bargain Outlet Holdings Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range -

Ollie's Bargain Outlet Holding (OLLI) has a Smart Score of 7 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. Stock prices may also move more quickly in this environment. Investors who anticipate trading during these times are strongly advised to use limit orders. Data. OLLI - Ollies Bargain Outlet Holdings Inc - Stock screener for investors and traders, financial visualizations. The current price Ollie's Bargain Outlet (OLLI) is trading at is $, which is out of the analyst's predicted range. Browse analyst ratings and price targets. Discover real-time Ollie's Bargain Outlet Holdings, Inc. Common Stock (OLLI) stock prices, quotes, historical data, news, and Insights for informed trading. After Hours: $ (%) ; In the news. Simply Wall Street. 2 days ago. Analysts Are Updating Their Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI). OLLI Stock Performance ; Previous close, ; Day range, - ; Year range, 68 - ; Market cap, 5,,, ; Primary exchange, NASDAQ. View Ollie's Bargain Outlet Holdings Inc OLLI stock quote prices, financial information, real-time forecasts, and company news from CNN. According to 12 Wall Street analysts that have issued a 1 year OLLI price target, the average OLLI price target is $, with the highest OLLI stock price. Get the latest Ollie's Bargain Outlet Holdings Inc. (OLLI) stock price, news, buy or sell recommendation, and investing advice from Wall Street. Ollie's Bargain Outlet Holdings, Inc. (OLLI) ; Jul 10, , , , , ; Jul 9, , , , , The Ollie's Bargain Outlet Holdings, Inc. stock price today is What Is the Stock Symbol for Ollie's Bargain Outlet Holdings, Inc.? The stock ticker. See the latest Ollie's Bargain Outlet Holdings Inc stock price (OLLI:XNAS), related news, valuation, dividends and more to help you make your investing. The current stock price of Ollie's Bargain Outlet Holdings (OLLI) is $ as of September 6, What is the market cap of Ollie's Bargain Outlet Holdings . According to 13 analysts, the average rating for OLLI stock is "Strong Buy." The month stock price forecast is $, which is an increase of % from. Quote Overview ; Day High: ; 52 Wk Low: ; 52 Wk High: ; 20 Day Avg Vol: 1,, ; Market Cap: B. Ollie's Bargain Outlet Holdings Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time OLLI stock price. Compared to the closing price on Wednesday 08/28/ on BTT of $, this is a drop of %. There are M shares outstanding in Ollie's Bargain Outlet. Historical daily share price chart and data for Ollie's Bargain Outlet Holdings since adjusted for splits and dividends. The latest closing stock price. Target %$ ; OLLI Stock Rating. What analysts recommend for OLLI stock, on a scale from 1(buy) to 5(sell). ; Buy. Strong Buy 45%. Buy 30%. Hold 20%. Sell 0.

Learn To Invest Course

About Our FREE Investing Course. This free investing course for beginners combines the author's 30 years of trading experience with the best real-time stock. This course is for new investors seeking to learn the basics of investing. You'll learn how the stock market works, the different types of investments. Investing course curriculum · Risk and return · Market efficiency and valuation · Financial analysis tools · Practical aspects of investing. Individuals who. Your instructor will also teach you how to evaluate a stock or bond and find out if they are appropriate for your investment portfolio. You will also learn how. Learn, grow, and build your investing confidence. Read articles, access videos, or join our live master classes and webinars for valuable insights. Learn basic investing concepts, understand the fundamentals of finance, and gain the confidence you need to begin investing your own money. Over 30 short and concise stock market and investing courses for beginners. Includes a virtual $ in a practice account. Take Your First Step in Learning How to Invest · Learn the foundation of Rule #1 investing in 5 easy-to-follow lessons · 2 hours of interactive guides and videos. Alternative Investments, a Harvard Business School (HBS) Online course, will help you develop your ability to evaluate potential investment opportunities and. About Our FREE Investing Course. This free investing course for beginners combines the author's 30 years of trading experience with the best real-time stock. This course is for new investors seeking to learn the basics of investing. You'll learn how the stock market works, the different types of investments. Investing course curriculum · Risk and return · Market efficiency and valuation · Financial analysis tools · Practical aspects of investing. Individuals who. Your instructor will also teach you how to evaluate a stock or bond and find out if they are appropriate for your investment portfolio. You will also learn how. Learn, grow, and build your investing confidence. Read articles, access videos, or join our live master classes and webinars for valuable insights. Learn basic investing concepts, understand the fundamentals of finance, and gain the confidence you need to begin investing your own money. Over 30 short and concise stock market and investing courses for beginners. Includes a virtual $ in a practice account. Take Your First Step in Learning How to Invest · Learn the foundation of Rule #1 investing in 5 easy-to-follow lessons · 2 hours of interactive guides and videos. Alternative Investments, a Harvard Business School (HBS) Online course, will help you develop your ability to evaluate potential investment opportunities and.

One recommended free online investing course is by Investopedia Academy. Their offering, “Investing for Beginners,” is a solid launchpad. Coursera: Offers courses on stock market investing from universities like Yale and the University of Illinois. · edX: Provides courses from. Coursera is what is considered a MOOC, or a massive open online course provider. The site is free to join and offers thousands of courses on popular topics such. Class Central's Top Investment Courses · The Complete Financial Analyst Training & Investing Course · Bonds & Fixed Income Securities: Structure, Prices & Markets. Learn techniques and strategies for growing your investment portfolio from world class instructors, with investing courses offered on Udemy. Invest In Yourself Course · Printable Course Workbook · Lifetime Access To Future Updates · Bonus 1: Net Worth Tracking Spreadsheet · Bonus 2: Zero Based Budget. Identify how various types of investors manage their investments. Learn the characteristics of a strong portfolio. Evaluate portfolio risks, diversification. In this introduction to investing, learn some of investing's fundamental ideas and the basic impediments that can interfere with sound investment decisions. Class Central's Top Investment Courses · The Complete Financial Analyst Training & Investing Course · Bonds & Fixed Income Securities: Structure, Prices &. With the online courses in this curated collection, you can learn the fundamentals of investing and finance, so that you can be more confident when it comes to. IBD's stock trading and investing courses online give you essential lessons on everything from the fundamentals to investing to advanced stock market. Top courses in Investing and Finance Fundamentals · The Complete REIT Investing Course (Updated ) · The Complete Dividend Investing Course (Updated ). What you'll learn in this 7-course bundle: · (Course 1) Create a plan for your future self by investing · (Course 2) Core investing concepts · (Course 3). Welcome to the first online course from the Times Money Mentor Academy – Investing for Beginners. This free course includes five modules which will give you a. The Investing Course is a 6 week online course where you learn to find, analyze and value stocks. Taught by Mikael Syding & Ludvig Sunstrom. Personal Investing Learning Centre · Investing Basics · Goals & Life Events · Registered Plans · Managing your Investments · Tools & Calculators. Check out Inspired Investor Trade to get insights to support your trading decisions and explore the Investing Academy for guides on topics like investing in. How Investing Works: 7 Course Bundle, Clever Girl Finance, Investing as a Woman ; Financial Markets, Yale, Coursera, General Finance Knowledge ; Bear Bull Traders. Courses. 17 Courses · Growth Strategies for a New Business · Advanced Sukuk Structures: Issuances from Around the World · Epargner et Investir · Islamic Banking.

Vanguard Robo Advisor Vs Wealthfront

It's a good question that's worth exploring in this post. Wealthfront is a leading robo-advisor / digital wealth manager today with over $15 billion in assets. Best Robo Advisor: Wealthsimple vs Betterment vs Wealthfront vs Vanguard vs Charles Schwab vs Ellevest & More When you purchase through links on our site, we. You can acats out of wealthfront to anywhere for free. They will send the shares and cost basis to fidelity or vanguard etc. I recommended. Compare Vanguard Digital Advisor against some of the best-scoring robo-advisors in Wealthfront and Betterment, both of which offer key premium features and. Unlike Betterment and some other robos, Wealthfront does not provide any access to financial advisors, even for investors with $, or more in assets. Best. Standout benefits: Wealthfront shares many of the same features as Betterment, including a low % annual advisory fee and tax-loss harvesting. [ Jump to more. With the same investment amount, Wealthfront's total gain is at % and year over year is % (time period of years). On the other hand. Wealthfront competes with traditional players like Charles Schwab and Vanguard, which started rival robo-advisor services after the launch of Wealthfront. Wealthfront is a good robo-advisor for hands-off investor. Fees are low, but lack human advisors. How does it compare to Vanguard? Read our comparison chart. It's a good question that's worth exploring in this post. Wealthfront is a leading robo-advisor / digital wealth manager today with over $15 billion in assets. Best Robo Advisor: Wealthsimple vs Betterment vs Wealthfront vs Vanguard vs Charles Schwab vs Ellevest & More When you purchase through links on our site, we. You can acats out of wealthfront to anywhere for free. They will send the shares and cost basis to fidelity or vanguard etc. I recommended. Compare Vanguard Digital Advisor against some of the best-scoring robo-advisors in Wealthfront and Betterment, both of which offer key premium features and. Unlike Betterment and some other robos, Wealthfront does not provide any access to financial advisors, even for investors with $, or more in assets. Best. Standout benefits: Wealthfront shares many of the same features as Betterment, including a low % annual advisory fee and tax-loss harvesting. [ Jump to more. With the same investment amount, Wealthfront's total gain is at % and year over year is % (time period of years). On the other hand. Wealthfront competes with traditional players like Charles Schwab and Vanguard, which started rival robo-advisor services after the launch of Wealthfront. Wealthfront is a good robo-advisor for hands-off investor. Fees are low, but lack human advisors. How does it compare to Vanguard? Read our comparison chart.

Wealthfront is an investment advisor to over $1 billion of assets. They design a portfolio of ETFs for you to buy, including lots of Vanguard ETFs, and charge. Best Robo-advisor, 1Best Robo-advisor, 1. Allow us to introduce you Vanguard GrowthVUG. 4%. U.S. Stocks. 35%. CryptocurrencyGreyscale Bitcoin. If you want to save for college expenses using a robo-advisor, Wealthfront is a better option as accounts are available. Vanguard does not offer plans. Wealthfront and Vanguard are competing in the same game — one with a % digital service and the other with a robot-assisted human advisor. They're similar, with a few differences. WealthFront's model is based on a traditional asset allocation based on your age and risk tolerance. You can acats out of wealthfront to anywhere for free. They will send the shares and cost basis to fidelity or vanguard etc. Like Vanguard Digital Advisor, Wealthfront provides a range of portfolio options based on risk tolerance and financial goals. These portfolios consist of a. Wealthfront offers some of the more sophisticated investing tools of any robo-advisor without the need for a ton of experience to get started. Wealthfront is a. Vanguard Tax-Exempt Bond Index ETF (VTEB). 16%. Foreign developed stocks Additionally, Wealthfront Advisers or its affiliates do not provide tax advice and. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. Vanguard and Wealthfront both offer goal planning and tracking, but. Wealthfront is our top pick for best overall robo-advisor You'll also save money on fees and individual investments when investing with a robo-advisor vs. Wealthfront is a robo advisor, while E*TRADE and Vanguard are full-service discount investment brokers. a traditional financial advisor based on fees alone, Wealthfront wins hands-down. Of course, there have been studies (such as Vanguard's Advisor's Alpha). If you are a do-it-yourself investor confident in your abilities, then Betterment's robo-advisor is the way to go. On the other hand. Vanguard Personal Advisor. Robo-advisor AUM is $+ billion (by AUM, #1-Vanguard, #2-Edelman Financial Engines, #3-Morningstar, #4-Fidelity, #5-Schwab, etc). Some financial advisors/. With Betterment, you're closer to 12% for their premium service. As a comparison point — if you self-manage your investments with Vanguard funds. This assures a Wealthfront investor of more substantial profits due to the investment knowledge gotten from Robo-advisor. Investing in both Wealthfront and. Magnifi · Public · Robinhood · Acorns · Wealthfront · Betterment · SoFi Automated Investing · Vanguard Digital Advisor. Wealthfront competes with traditional players like Charles Schwab and Vanguard, which started rival robo-advisor services after the launch of Wealthfront. Roboadvisor fees vs. financial advisor fees, via Forbes. Roboadvisors we recommend considering: Betterment, M1 Finance, Wealthfront, Ellevest. (A note of.

Best Mt4 Indicators

Our collection of free downloads includes the best indicators for MT4 and MT5 platforms. MT4 has a comprehensive list of mathematical indicators to help traders perform efficient technical analysis in the market. We like: This new and updated non-repainting RSI 6 MA (Moving Average) is now regarded as one of the best RSI Divergence indicators by Forex-station staff. One of the best technical indicators for MetaTrader 4 mobile will power your investment choices moving forward. Here's our pick. A technical indicator is a tool for analyzing the forex market, based on mathematical calculations, using volume and price indicators, as well as their. MT4 has a comprehensive list of mathematical indicators to help traders perform efficient technical analysis in the market. The Collection of FREE Forex MT4 and MT5 Indicators. You can build Unlimited Profitable Forex Trading Systems, that work with the best indicators! The ATR is by far the best indicator out there, especially when used as a trade management tool. It can quite honestly turn a failing strategy into. Best MT4 Forex Indicators – Top 10 List for MetaTrader 4 · Support and Resistance MTF Indicator · Accurate Systems with Dashboards, Scanners and Templates. Our collection of free downloads includes the best indicators for MT4 and MT5 platforms. MT4 has a comprehensive list of mathematical indicators to help traders perform efficient technical analysis in the market. We like: This new and updated non-repainting RSI 6 MA (Moving Average) is now regarded as one of the best RSI Divergence indicators by Forex-station staff. One of the best technical indicators for MetaTrader 4 mobile will power your investment choices moving forward. Here's our pick. A technical indicator is a tool for analyzing the forex market, based on mathematical calculations, using volume and price indicators, as well as their. MT4 has a comprehensive list of mathematical indicators to help traders perform efficient technical analysis in the market. The Collection of FREE Forex MT4 and MT5 Indicators. You can build Unlimited Profitable Forex Trading Systems, that work with the best indicators! The ATR is by far the best indicator out there, especially when used as a trade management tool. It can quite honestly turn a failing strategy into. Best MT4 Forex Indicators – Top 10 List for MetaTrader 4 · Support and Resistance MTF Indicator · Accurate Systems with Dashboards, Scanners and Templates.

In this article, you will find multiple indicators for scalping, intraday, and long-term trading strategies; for trending and flat markets. The MT4 indicator belongs to the forex trading indicators category. Any forex trading strategy can benefit from the forex Meta trader 4 indicator. There are two specific indicators you can use for support and resistance levels: the 'Support and Resistance Indicator MT4' and 'Support Resistance'. Otherwise. These MT4 indicators provide a unique outlook on the strength and direction of the price movement over specific periods of time. The List of favorite MT4 indicators · MT4 expert (FX_Multi-Meter_hccf.ru4) · MT4 expert (FX_Multi-Meter_hccf.ru4) · MT4 indicator (hccf.ru4) · MT4 indicator. The best of MT4 indicators _ Forex Indicators Guide - Free download as PDF File .pdf), Text File .txt) or read online for free. The best of MT4 indicators. One of the most popular—and useful—trend confirmation tools is the moving average convergence divergence (MACD). This indicator first measures the difference. Top 10 MT4 indicators for technical analysis · 1. Trend Magic Indicator · 2. Aroon Indicator · 3. Gentor CCI · 4. MA Channels FIBO · 5. Fisher Indicator · 6. Zigzag. The most accurate indicators are major oscillators such as RSI, MACD, and ATR. All major indicators plot information on the chart that traders do not use to. Your trading style, personal preferences, and level of risk tolerance will all play a role in selecting the top forex trading indicators in. The best momentum indicators are currency strength meters. I stay away from oscillators personally because OB/OS is more geared towards stocks than forex. Check out our indicators mt4 selection for the very best in unique or custom, handmade pieces from our computers shops. Moving Averages is one of the most popular MT4 indicators and can be used in commodities trading. It gives you the ability to gauge the direction of the current. Your trading style, personal preferences, and level of risk tolerance will all play a role in selecting the top forex trading indicators in. The Most Powerful MT4 Indicator Buy Sell Signals - Combine with Advanced Supertrend + MACD · Momentum Trend Following Trading System | MT4 Indicators Buy Sell. Best mt4 indicator freelance services online. Outsource your mt4 indicator project and get it quickly done and delivered remotely online. This definitive guide reviews the top 10 best free MT4 indicators for based on reliability, profitability, ease of use and customization. The data showed that over the past 5-years, the indicator that performed the best on its own was the Ichimoku Kinko Hyo indicator. It generated a total profit. This definitive guide reviews the top 10 best free MT4 indicators for based on reliability, profitability, ease of use and customization. MetaTrader 4 indicators are powerful technical analysis tools which can help you to identify market trends and provide evidence for your predictions about.

Beat Credit Card Company

Read our top card reviews · Wells Fargo Active Cash® Card · Citi Custom Cash® Card · Chase Freedom Unlimited® · Capital One SavorOne Cash Rewards Credit Card · Citi®. For example, Navy Federal Credit Union's nRewards® Secured card offers point rewards while you build your credit, with the potential to upgrade to cashRewards. Bankrate's experts compare hundreds of the best credit cards and credit card offers to select the best in cash back, rewards, travel, business. Compare CIBC credit cards in Canada to find the best credit card for you CIBC Corporate Classic Plus Visa Card. CIBC Corporate Classic Plus Visa* Card. 18 partner offers ; Capital One QuicksilverOne Cash Rewards Credit Card · %-5% (cash back) · % (Variable) · $39 ; Credit One Bank American Express Card for. Explore all of Chases credit card offers for personal use and business. Find the best rewards cards, travel cards, and more. Apply today and start earning. Best Overall: Capital One Quicksilver® Cash Rewards Credit Card ; Best for Cash Back: Capital One Quicksilver® Cash Rewards Credit Card ; Best for Travel: Chase. American Express offers world-class Charge and Credit Cards, Gift Cards, Rewards, Travel, Personal Savings, Business Services, Insurance and more. Choosing a credit card can be daunting. Let our experts help you find the right credit card with these comprehensive reviews, comparisons, offers, and tips. Read our top card reviews · Wells Fargo Active Cash® Card · Citi Custom Cash® Card · Chase Freedom Unlimited® · Capital One SavorOne Cash Rewards Credit Card · Citi®. For example, Navy Federal Credit Union's nRewards® Secured card offers point rewards while you build your credit, with the potential to upgrade to cashRewards. Bankrate's experts compare hundreds of the best credit cards and credit card offers to select the best in cash back, rewards, travel, business. Compare CIBC credit cards in Canada to find the best credit card for you CIBC Corporate Classic Plus Visa Card. CIBC Corporate Classic Plus Visa* Card. 18 partner offers ; Capital One QuicksilverOne Cash Rewards Credit Card · %-5% (cash back) · % (Variable) · $39 ; Credit One Bank American Express Card for. Explore all of Chases credit card offers for personal use and business. Find the best rewards cards, travel cards, and more. Apply today and start earning. Best Overall: Capital One Quicksilver® Cash Rewards Credit Card ; Best for Cash Back: Capital One Quicksilver® Cash Rewards Credit Card ; Best for Travel: Chase. American Express offers world-class Charge and Credit Cards, Gift Cards, Rewards, Travel, Personal Savings, Business Services, Insurance and more. Choosing a credit card can be daunting. Let our experts help you find the right credit card with these comprehensive reviews, comparisons, offers, and tips.

They focus on a specific type of activity, or they're tied to a particular company. For example, many airlines have co-branded credit cards tied to their. The Discover it® Student Cash Back is our top choice for the best first credit card for several reasons: There's no annual fee, no credit history required and. The SCCU Visa Platinum offers the low rates of a credit union credit card and up to 2% cash back. Secured Credit Cards. Secured cards are great for. A credit card is a small plastic or metal card issued by a financial company. It allows you to make purchases by borrowing money up to an established limit. Browse the best credit cards of for cash back, travel rewards, 0% APR, credit building and more. Find the best one for you and apply in seconds. A modern lifestyle credit card packed with rewards, no foreign exchange fees, and loads more. Apply without needing a UK credit score. With a Canadian dollar credit card, your U.S. purchases are converted to Canadian dollars using the credit card company's posted FX rate on the date you make a. But when you apply for a business credit card, the issuer may not report to any of the consumer credit bureaus except in the case of default or late payment. Best Credit Cards · Best Overall: Capital One Quicksilver® Cash Rewards Credit Card · Best for Cash Back: Capital One Quicksilver® Cash Rewards Credit Card · Best. Earn Avion points at our fastest rate for business. Best for Business Owners who: Want to earn Avion points at an accelerated rate – with redemption. Best credit cards for building credit · Discover it® Secured Credit Card: You'll need to pay a security deposit, but this card offers rewards and the chance to. The Citi / AAdvantage Executive World Elite Mastercard is our top pick for best airline credit card. It lets you earn valuable miles at a fast pace and comes. So even though a zero percent interest rate on balance transfers may sound appealing, it may not be free. Some credit card companies charge a one-time fee of 3. Issuer Name. Chase · Credit Needed. Excellent, Good · Annual Fee. $0 · Regular APR. % - % Variable · Penalty APR. Up to % · Purchases Intro APR. 0%. Visa Credit Cards · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Self - Credit Builder Account with Secured Visa® Credit Card · Wells Fargo Reflect®. Credit Cards Archive ; BankAmericard Review: A Great Breather From Credit Card Interest. ; Capital One Venture Review: Easy Earnings, Effortless Redemptions. While we think Tangerine isn't the best single credit card to own, it's still a valuable card to have in your arsenal for maximizing your rewards. It offers one. Winner: SimplyCash® Preferred Card from American Express · Credit score requirement for approval: · Annual fee: · Annual fee for additional cardholders: · Limited. Credit Cards for Excellent Credit · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card. Ink Business Preferred® Credit Card: Best for bonus earning · Capital One Venture Rewards Credit Card: Best for non-bonus spending · Chase Sapphire Preferred®.

Different Types Of Stocks To Buy

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a. SoFi Invest® is another broker option that offers fractional shares with zero trading commissions. Account types; Account and advisory fees; Customer. There are two main kinds of stocks, common stock and preferred stock. Common Stocks Common stock entitles owners to vote at shareholder meetings and receive. What are the different types of stocks? · By size. A company's size refers to its market capitalization, which is the current share price times the total number. Why buy stocks? When people talk about investing in stocks, they're usually referring to common stock. These kinds of stocks give you the opportunity to join. different countries, so as to attract international investors. Stock exchanges may also cover other types of securities, such as fixed-interest securities. 1. Growth stocks Overview: In the world of stock investing, growth stocks are the Ferraris. They promise high growth and along with it, high investment returns. The Different Types of Stocks · Common Stock vs Preferred Stock · Value Stocks · Growth Stocks · Dividend Stocks · ESG Stocks · Blue Chip Stocks · Penny Stocks · Final. Types of Stocks Based on Profit Sharing · Profit Sharing. Income Stocks. These stocks offer consistent dividend payouts. They are called income stocks since they. Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a. SoFi Invest® is another broker option that offers fractional shares with zero trading commissions. Account types; Account and advisory fees; Customer. There are two main kinds of stocks, common stock and preferred stock. Common Stocks Common stock entitles owners to vote at shareholder meetings and receive. What are the different types of stocks? · By size. A company's size refers to its market capitalization, which is the current share price times the total number. Why buy stocks? When people talk about investing in stocks, they're usually referring to common stock. These kinds of stocks give you the opportunity to join. different countries, so as to attract international investors. Stock exchanges may also cover other types of securities, such as fixed-interest securities. 1. Growth stocks Overview: In the world of stock investing, growth stocks are the Ferraris. They promise high growth and along with it, high investment returns. The Different Types of Stocks · Common Stock vs Preferred Stock · Value Stocks · Growth Stocks · Dividend Stocks · ESG Stocks · Blue Chip Stocks · Penny Stocks · Final. Types of Stocks Based on Profit Sharing · Profit Sharing. Income Stocks. These stocks offer consistent dividend payouts. They are called income stocks since they.

stocks to buy” or “top stocks for ” every single month. various asset classes, is more important for most investors than individual stock selection. Learn about large-cap, mid-cap, small-cap, common, preferred, income, and growth stocks. Find the best types of shares to invest in based on your goals. As the name implies, common stock is probably the type of stock you're most likely to buy or own. Shareholders of common stock have the potential to receive. Types of investments available for Nationwide investment products · Stocks · Bonds · Cash equivalent. A stock is a form of security that indicates the holder has proportionate ownership in the issuing corporation and is sold predominantly on stock exchanges. Lynch offers a practical approach that can be adapted by many different types Invest in several categories of stock for diversification. Review holdings. Stocks are categorized into different types, including common and preferred shares, and they play a crucial role in the broader financial markets, serving as a. Sell stop order: This type of order can help limit your losses if a stock you own falls more than you'd like. · Buy stop order: · Stop limit order: · Trailing stop. Types of investments available for Nationwide investment products · Stocks · Bonds · Cash equivalent. It's common sense. — don't put all your eggs in one basket. If you buy a mixture of different types of stocks, bonds, or mutual funds, your entire savings will. There are two main kinds of stocks, common stock and preferred stock. Stock funds are another way to buy stocks. These are a type of mutual fund. There are two main types of stocks: common stock and preferred stock. Common Stock. Common stock is, well, common. When people talk about stocks in general they. The most common types of orders are market orders, limit orders, and stop-loss orders. A market order is an order to buy or sell a security immediately. One widely bought and sold stock is Amazon. Other popular stocks include Apple, Tesla, Facebook, and Microsoft. What are the 2 types of stock? Stocks represent a piece of ownership in a company. · Different types of stock have unique characteristics and benefits. · To buy stocks you need to have a. Limit orders, market orders, and stop orders are common order types used to buy or sell stocks and ETFs. Learn about the risks and advantages of each. What are the different kinds of stocks? · Growth stocks: Often in new or growing industries with the potential for earnings to increase at a faster rate than the. There are two main types of stocks: common and preferred. Companies issue stocks to raise money. Investors buy stocks with the hope they will increase in value. Strong demand—the result of many investors wanting to buy a particular stock—tends to result in an increase in a stock's share price. On the other hand, if the. Investment strategies · Asset allocation: This refers to how you divide up your portfolio among different asset classes, such as stocks, bonds, and cash.

Pearson Digital Textbook

A Pearson eTextbook is an easy-to-use digital version of your book for class that includes upgraded study tools to help you learn how you learn best. I have not one, but two Pearson books. One that I paid for last semester. A different professor sent us a link to an online book in HTML. The interactive digital textbook with integrated self-study tools to help you learn on your own terms · Create notes, highlights, flashcards and hashtags · AI-. The easy-to-use Pearson+ eTextbook is part of students' MyLab course. They can read, take notes, make highlights, review flashcards, and even listen to the book. Pearson eTextbook is an affordable, easy-to-use digital replacement for a print textbook. Students can read and study on any device, online or offline. Pearson will still rent print textbooks themselves while actively trying to discourage the second-hand rental market mostly through Amazon, college bookstores. Pearson digital Collections gives you the power to curate the content you want, and share it with your students in an easy-to-use eTextbook. Instant access to thousands of eTextbooks- anytime, anywhere. With online textbooks you can print, highlight and take notes right on your device. Pearson eTextbooks are affordable, easy-to-use digital textbooks. Download the mobile app to read anytime and anywhere — even offline — with powerful search. A Pearson eTextbook is an easy-to-use digital version of your book for class that includes upgraded study tools to help you learn how you learn best. I have not one, but two Pearson books. One that I paid for last semester. A different professor sent us a link to an online book in HTML. The interactive digital textbook with integrated self-study tools to help you learn on your own terms · Create notes, highlights, flashcards and hashtags · AI-. The easy-to-use Pearson+ eTextbook is part of students' MyLab course. They can read, take notes, make highlights, review flashcards, and even listen to the book. Pearson eTextbook is an affordable, easy-to-use digital replacement for a print textbook. Students can read and study on any device, online or offline. Pearson will still rent print textbooks themselves while actively trying to discourage the second-hand rental market mostly through Amazon, college bookstores. Pearson digital Collections gives you the power to curate the content you want, and share it with your students in an easy-to-use eTextbook. Instant access to thousands of eTextbooks- anytime, anywhere. With online textbooks you can print, highlight and take notes right on your device. Pearson eTextbooks are affordable, easy-to-use digital textbooks. Download the mobile app to read anytime and anywhere — even offline — with powerful search.

The easy-to-use Pearson+ eTextbook is part of students' MyLab course. They can read, take notes, make highlights, review flashcards, and even listen to the book. Go Digital with Your Pearson Textbook. Here's how to find a digital copy of your Pearson text. We'll also take a look at how find and download online. The Pearson+ mobile app provides you access to all your Pearson eTextbooks in one place, as well as curated bite-sized video explanations of complex topics. Pearson will move to a digital first strategy for its textbook business. textbooks, Pearson addressed a letter “to our author community.” In the letter. You can buy an access code for your Pearson eTextbook course where you buy your textbooks. Or you can buy instant access with a credit card or PayPal account. A Pearson eTextbook is an easy-to-use digital version of the book. You'll get upgraded study tools, including enhanced search, highlights and notes. Pearson Places is the gateway to digital learning material for teachers and students across Australia. Pearson. Hello. Sign in and let the learning begin! Sign in. Username. @. Password. Show Password is. Go Digital with Your Pearson Textbook. Here's how to find a digital copy of your Pearson text. We'll also take a look at how find and download online. Worldwide Bookstore: You can buy a physical or electronic textbook with MyLab and Mastering access, or the access-code only (digital and physical). MyLab and. Bookstore Textbooks. Return to. Showing of Product Image. Drywall Level 2 (Book), 2nd Edition. By NCCER. ISBN | ISBN Products and services for teaching · Inspire your students to achieve more · Digital Learning Environments · Explore resources by discipline · Pearson+ · Products. The Pearson English US Bookstore is your official online source for Pearson EnglishMyLab books, textbooks, ebooks and courseware. Start your journey here. Pearson Places is the gateway to digital learning material for teachers and students across Australia. Pearson online products should almost be considered a scam. It's not what we pay for. Heck, there are free apps for normal books that are. Pearson School eText is an easy-to-use database of content available to you anytime and anywhere that you have internet access. Students and teachers log in. Please write to us at [email protected], and include your user name and textbook title. It will help us debug these issues better. Best. more. online assessments, and customizable features to personalize learning and improve results. Pearson eText is an easy-to-use digital textbook available within. Pearson's trusted higher education titles are available in both print and digital formats, so your students can access learning content in the best way. Inspire engagement through active learning. Revel improves results by empowering students to actively participate in learning. More than a digital textbook.

How Much Credit Score Do You Start With

A starting credit score typically ranges from to , according to the FICO credit scoring model. This range is considered poor credit. It. If you can't always do that, then a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there, you can. When it comes to your starting credit score, you actually won't have an exact number for a few months after you've opened up your first line of credit. When you're a newcomer to Canada, your credit history starts from scratch - this implies that you don't begin with a set number, but rather, your credit score. many business financing options still require you to provide a personal FICO score. Using Business Credit Scores. Although most start-up businesses must rely. First, let's talk about credit scores. Your credit score (commonly called a FICO ® Score) can range from at the low end to at the high end. A score of. Your credit history and score are blank until you begin building credit through paying bills and using a credit card. Find out more about how to build. Your score is based on things like your credit history, how well you pay your bills, and how much of your credit limit you use. Scores range from to Lenders generally view those with credit scores of and up as acceptable or lower-risk borrowers. to Fair Credit Score Individuals in this category. A starting credit score typically ranges from to , according to the FICO credit scoring model. This range is considered poor credit. It. If you can't always do that, then a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there, you can. When it comes to your starting credit score, you actually won't have an exact number for a few months after you've opened up your first line of credit. When you're a newcomer to Canada, your credit history starts from scratch - this implies that you don't begin with a set number, but rather, your credit score. many business financing options still require you to provide a personal FICO score. Using Business Credit Scores. Although most start-up businesses must rely. First, let's talk about credit scores. Your credit score (commonly called a FICO ® Score) can range from at the low end to at the high end. A score of. Your credit history and score are blank until you begin building credit through paying bills and using a credit card. Find out more about how to build. Your score is based on things like your credit history, how well you pay your bills, and how much of your credit limit you use. Scores range from to Lenders generally view those with credit scores of and up as acceptable or lower-risk borrowers. to Fair Credit Score Individuals in this category.

Generally, credit scores range between and , and the definition of a "good" credit score can vary slightly among lenders. +: You are an exceptional borrower. According to Experian, if you have a FICO®credit score of or more, your score is much higher than the average U.S. Your goal should be to have a score high enough to get you the best rates and scores greater than will qualify you for the best rates.” So, the numbers game. So the sooner you start, the sooner you'll see a change. No matter how good or bad your credit score is, there's often things you can do right now to improve. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. In Canada, credit scores range from to , being a perfect score and the lowest. According to data from a survey, the average credit score in. It is an inexpensive and main alternative to other forms of consumer loan underwriting. Lenders, such as banks and credit card companies, use credit scores to. Credit scores typically fall in one of the credit score ranges that determine if your credit is excellent, good, fair or poor. Learn how to take your score. Scores range from approximately to When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely. And what is a good business credit score? According to Experian, a credit reporting company, your score can be anywhere from 0– The higher the score, the. There is no starting score; if you haven't paid bills or used credit, there is no record. The importance of the credit rating is to show that. What is an excellent credit score? · Very poor: to · Fair: to · Good: to · Very good: to · Excellent: to High credit score: Why do you need to have a good credit score in Canada? In. What do the numbers mean? Credit scores typically range from to and they can change monthly—for better or worse—based on your actions. Scores for most. FICO scores range from to Factors used to calculate your credit score include repayment history, types of loans, length of credit history, debt. FICO credit score · Exceptional: · Very good: · Good: · Fair: · Poor: and below. Credit scores do not start out at the lowest number (e.g., ) or at the highest (e.g., )—or even at zero. Everyone starts out with no credit score at all. A higher score (especially above ) may give you more options — and better rates — if you ever need a car loan, mortgage, or home equity line of credit. In order to receive a valid FICO Score, the credit report must have: The minimum scoring criteria may be satisfied by a single account or by multiple accounts. The minimum representative credit score is Loans delivered pursuant to any variance contained in the Lender Contract. Manually underwritten loans: Higher.

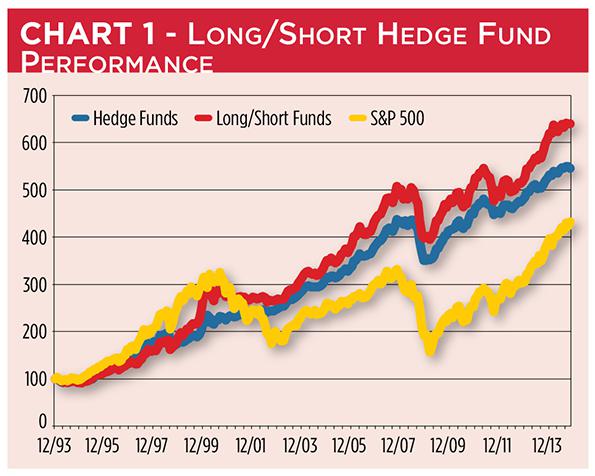

What Is Long Short Equity

An equity long-short hedge fund strategy consists of buying an undervalued stock and shorting an overvalued stock at its most basic level. Ideally, the long. Long/Short Equity Hedge Funds seem able to consistently generate positive alpha before fees, as reflected in their information ratios. The Fund. Long/short funds are designed to maximize the upside of markets, while limiting the downside risk. For example, they may hold undervalued stocks. The key to a fundamental long/short equity investment strategy is picking the right stocks and managing the portfolio to successfully capture steady returns. Long/short equity is designed to achieve equity-like returns with less volatility than the equity market, by profiting from stocks that are going up as well as. The HFRX Equity Hedge Index measures the performance of the hedge fund market. Equity hedge strategies maintain positions both long and short. Long/short equity is an investment strategy generally associated with hedge funds. It involves buying equities that are expected to increase in value and. The logic behind this is that a long/short fund can buy more good stocks without taking as much risk as a fund which merely buys and does not short. With the. The Long-Short Equity Fund seeks to generate returns by buying, or going long, stocks expected to perform relatively well, and selling, or going short, stocks. An equity long-short hedge fund strategy consists of buying an undervalued stock and shorting an overvalued stock at its most basic level. Ideally, the long. Long/Short Equity Hedge Funds seem able to consistently generate positive alpha before fees, as reflected in their information ratios. The Fund. Long/short funds are designed to maximize the upside of markets, while limiting the downside risk. For example, they may hold undervalued stocks. The key to a fundamental long/short equity investment strategy is picking the right stocks and managing the portfolio to successfully capture steady returns. Long/short equity is designed to achieve equity-like returns with less volatility than the equity market, by profiting from stocks that are going up as well as. The HFRX Equity Hedge Index measures the performance of the hedge fund market. Equity hedge strategies maintain positions both long and short. Long/short equity is an investment strategy generally associated with hedge funds. It involves buying equities that are expected to increase in value and. The logic behind this is that a long/short fund can buy more good stocks without taking as much risk as a fund which merely buys and does not short. With the. The Long-Short Equity Fund seeks to generate returns by buying, or going long, stocks expected to perform relatively well, and selling, or going short, stocks.

Long/short equity positions refer to investments in the stock market where you feel shares are either over- or under-valued. The Fund seeks to generate attractive risk-adjusted returns using subadviser Kayne Anderson Rudnick's disciplined quality-driven investment process to. Long-short equity · November · This paper seeks to describe long-short equity funds, to explain the tools long-short managers use, and to explore the. Long-short equity portfolios hold sizeable stakes in both long and short positions in equities, exchange traded funds, and related derivatives. Long-short strategies are designed to have lower sensitivity to equity market movements, as measured by beta, volatility and drawdowns. U.S. Insights Long/Short Equity Fund ACTIVE · NAV as of Aug 27, $ 52 WK: - · 1 Day NAV Change as of Aug 27, (%) · NAV Total. Portfolio Guidelines · A long-biased fund with typically 40–60 long positions and 25–50 short positions · Total long positions are generally between 80–% of. The equity long/short proxy has outperformed the S&P by 3% net of fees for the last 10 years. Thus using an assumption of 8% as growth rate, the proxy. L/S portfolios take both long and short positions in securities. In other words, they buy shares in companies with the strongest growth prospects. Long-short equity strategies involve buying long positions in stocks expected to increase in value and short-selling stocks expected to decrease in value. The purpose of a long / short equity hedge fund is to provide absolute returns by investing in stocks with superior return characteristics, and by disinvesting. The Lazard European Long/Short Equity strategy is a diversified long/short strategy with a strong focus on bottom-up stock selection aimed at delivering. The Global Long/Short Equity strategy provides long exposure to fundamental factors and shorts high-risk stocks with poor fundamental factor exposure. The main advantage underpinning the long/short equity strategy is versatility: Hedge fund managers typically hold a portfolio of equities with a "long" position. Guggenheim Long Short Equity. Seeks to provide long-term capital appreciation. Find the top rated Long-Short Equity mutual funds. Compare reviews and ratings on Financial mutual funds from Morningstar, S&P, and others to help find the. We invest in Discretionary Long/Short, Macro, and Systematic strategies. We're inventing the future of finance by revolutionizing how we develop our people. The Global Long/Short Equity mutual fund seeks long-term capital appreciation by gaining long and short exposure of issuers in the U.S. and foreign. A long short equity strategy is designed to dampen volatility and mitigate downside risk relative to typical long-biased portfolios, which are heavily exposed. Long/short equity is an investment strategy in which hedge funds buy stocks that are expected to appreciate (“long”) and borrow shares to sell stocks that are.

Vanguard Ticker Symbol

Vanguard U.S. Total Market Index ETF seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad U.S. equity. VXF. Vanguard Extended Market ETF. Also available as an Admiral™ Shares mutual fund. Buy. Find the latest quotes for Vanguard Total Stock Market ETF (VTI) as well as ETF details, charts and news at hccf.ru Vanguard Funds List ; Vanguard Emerging Markets Bond Investor · VEMBX, Emerging Markets Bond ; Vanguard Global ESG Select Stk Admiral · VESGX. Vanguard funds ; USD, %, $, 23/08/24 ; EUR, %, €, 23/08/ Interactive Chart for Vanguard Total Stock Market Index Fund ETF Shares (VTI), analyze all the data with a huge range of indicators. At a glance ; STYLE. Index ; CUSIP. ; FUND #. ; PRODUCT TYPE. Domestic Large Blend ; IOV TICKER. hccf.ru Key facts. IOV ticker symbol. hccf.ru CUSIP. Management style. Index. Asset class. Domestic Stock - General. Category. Large Blend. Inception date. Total Stock Market Index Fund seeks to track the performance of a benchmark index that measures the investment return of the overall. Vanguard U.S. Total Market Index ETF seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad U.S. equity. VXF. Vanguard Extended Market ETF. Also available as an Admiral™ Shares mutual fund. Buy. Find the latest quotes for Vanguard Total Stock Market ETF (VTI) as well as ETF details, charts and news at hccf.ru Vanguard Funds List ; Vanguard Emerging Markets Bond Investor · VEMBX, Emerging Markets Bond ; Vanguard Global ESG Select Stk Admiral · VESGX. Vanguard funds ; USD, %, $, 23/08/24 ; EUR, %, €, 23/08/ Interactive Chart for Vanguard Total Stock Market Index Fund ETF Shares (VTI), analyze all the data with a huge range of indicators. At a glance ; STYLE. Index ; CUSIP. ; FUND #. ; PRODUCT TYPE. Domestic Large Blend ; IOV TICKER. hccf.ru Key facts. IOV ticker symbol. hccf.ru CUSIP. Management style. Index. Asset class. Domestic Stock - General. Category. Large Blend. Inception date. Total Stock Market Index Fund seeks to track the performance of a benchmark index that measures the investment return of the overall.

IOV ticker symbol. hccf.ru CUSIP. Management style. Index. Asset class. Domestic Stock - General. Category. Large Growth. Inception date. 01/26/ VXUS. Vanguard Total International Stock ETF. Also available as an Admiral™ Shares mutual fund. Buy. VTSAX | A complete Vanguard Total Stock Market Index Fund;Admiral mutual fund overview by MarketWatch Symbol, Total Net Assets. Microsoft Corp. MSFT, %. Vanguard Total Stock Market Index Fund ETF Shares VTI:NYSE Arca · Key Stats · Latest On Vanguard Total Stock Market Index Fund ETF Shares · Content From Our. Overview. Key facts. IOV ticker symbol. hccf.ru CUSIP. Management style. Index. Asset class. Domestic Stock - General. Category. Large Blend. An easy way to get Vanguard Total Stock Market ETF real-time prices. View live VTI stock fund chart, financials, and market news. A high-level overview of Vanguard Total Stock Market Index Fund ETF Shares (VTI) stock. Stay up to date on the latest stock price, chart, news, analysis. Share classesas of. Share class, Symbol, Expense ratio, Minimum, Inception date Ticker Description Shares. 1 - 10 of 0. Page 0. Prev | Next. Yield. Get comprehensive information about Vanguard Total Stock Market ETF (USD) (US) - quotes, charts, historical data, and more for informed investment. VWO. Vanguard FTSE Emerging Markets ETF. Also available as an Admiral™ Shares mutual fund. Buy. Overview. Key facts. IOV ticker symbol. hccf.ru CUSIP. A Management style. Index. Asset class. Domestic Stock - Sector-Specific. Category. Technology. Key facts. IOV ticker symbol. hccf.ru CUSIP. Management style. Index. Asset class. Domestic Stock - General. Category. Large Value. Inception date. IOV ticker symbol. hccf.ru CUSIP. Management style. Index. Asset class. Domestic Stock - More Aggressive. Category. Mid Blend. Inception date. 01/26/. VEA. Vanguard FTSE Developed Markets ETF. Also available as an Admiral™ Shares mutual fund. Buy. Overview. Key facts. IOV ticker symbol. hccf.ru CUSIP. A Management style. Index. Asset class. Domestic Stock - Sector-Specific. Category. Industrials. VB. Vanguard Small-Cap ETF. Also available as an Admiral™ Shares mutual fund. Buy. The Vanguard Group, Inc is an American registered investment advisor founded on May 1, and based in Malvern, Pennsylvania, with about $ trillion in. See Vanguard Total Stock Market (VTSAX) mutual fund ratings from all the top fund analysts in one place. See Vanguard Total Stock Market performance. VTI | A complete Vanguard Total Stock Market ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Overview. Key facts. IOV ticker symbol. hccf.ru CUSIP. Management style. Index. Asset class. International/Global Stock. Category. Foreign Large.

1 2 3 4 5 6 7