hccf.ru News

News

Getting A Windshield Replaced Through Insurance

Schedule Windshield Repair and Auto Glass Service at Your Convenience · Get repairs – may typically be completed within 48 hours of filing your claim. · Choose. Repairing a damaged windshield or window is simple with Direct Auto Insurance Get a baseball through your car window? A chip in the glass turning into. If you have comprehensive coverage, then you should be covered for auto glass repair, including a full windshield replacement. At Progressive, if your glass. If you have glass coverage, we'll waive your deductible for windshield repairs. [1] Guarantee covers replacement of any defective alternative parts identified. In Massachusetts, glass and windshield coverage is provided by Comprehensive coverage in order for any repair or replacement of the glass and windshield to be. And in many cases, your insurance might cover the total cost of the replacement. If the damage to your windshield is minimal (for example, a small crack or chip). It's possible for your auto insurance to cover the cost of a cracked windshield. The policy you have with your insurance carrier will set forth. Can glass damage be repaired? · If you have the appropriate coverage, GEICO will waive your deductible when you have your glass repaired · The repair process only. To have your windshield replacement covered by insurance, a claim must be filed. After the incident occurs, contact your insurance agent. Follow the directions. Schedule Windshield Repair and Auto Glass Service at Your Convenience · Get repairs – may typically be completed within 48 hours of filing your claim. · Choose. Repairing a damaged windshield or window is simple with Direct Auto Insurance Get a baseball through your car window? A chip in the glass turning into. If you have comprehensive coverage, then you should be covered for auto glass repair, including a full windshield replacement. At Progressive, if your glass. If you have glass coverage, we'll waive your deductible for windshield repairs. [1] Guarantee covers replacement of any defective alternative parts identified. In Massachusetts, glass and windshield coverage is provided by Comprehensive coverage in order for any repair or replacement of the glass and windshield to be. And in many cases, your insurance might cover the total cost of the replacement. If the damage to your windshield is minimal (for example, a small crack or chip). It's possible for your auto insurance to cover the cost of a cracked windshield. The policy you have with your insurance carrier will set forth. Can glass damage be repaired? · If you have the appropriate coverage, GEICO will waive your deductible when you have your glass repaired · The repair process only. To have your windshield replacement covered by insurance, a claim must be filed. After the incident occurs, contact your insurance agent. Follow the directions.

In Massachusetts, glass and windshield coverage is provided by Comprehensive coverage in order for any repair or replacement of the glass and windshield to be. You must have comprehensive coverage on that vehicle for the insurer to replace the windshield. In that case, the deductible for comprehensive claims will be. Glass repair or replacement may be subject to the comprehensive coverage deductible on your auto policy. What should I do if I have glass damage? Report the. Florida is one of a few states in which windshield repair or replacement is covered with no deductible if your auto insurance policy includes comprehensive. Yes, Allstate will cover windshield replacement and repair. Allstate does not require a deductible for repairs, but a deductible may apply to replace a. In some states, it is legally mandated that insurance companies cannot apply a deductible to windshield repair, so be sure to check your local laws to see. With comprehensive coverage through Amica, if a glass repair is needed, such as filling a chip, your deductible might be able to be waived. Full glass coverage. Windshield dings and chips are easy to repair, and with American Family Insurance, they typically won't cost you any money out of your pocket. Getting it taken. That said, in the event that your vehicle requires a new windshield or window glass repair, filing a claim may not always be your best option. Why not? Our Only. But depending on your state and car insurance provider, you can get around the broken windshield deductible. Can Comprehensive Car Insurance Cover Windshield. Comprehensive coverage on a car insurance policy may help pay to repair or replace your windshield if it's cracked or shattered by a rock. Another coverage. Before submitting a windshield replacement claim to Safelite, get answers to common questions on windshield insurance through our help center. Learn more. Had a large crack in mine a few months back. I went through insurance and paid my deductible. Insurance, claimed they would only cover $ total for repair. However, your windshield replacement cost with insurance can go as low as $0! That's right, if you just choose to work with the right auto glass repair &. However, there are factors unique to each situation. For example, if a repair is unsuccessful and the windshield needs to be replaced, a deductible will likely. Note that comprehensive coverage is optional, but most drivers add comprehensive insurance to their car insurance policy to get covered for windshield glass. Using your insurance coverage could be wise if it seems likely that you will have to get a new windshield entirely. However, if it's just a small chip or minor. Windshield repairs and replacement would typically be covered under the comprehensive coverage portion of your policy. Auto glass damage such as windshield. Drivers can get windshield replacement or repair coverage from some auto insurance companies without having to pay a deductible. Some companies include this in. Do you have a broken windshield or side glass and want to get it replaced using your insurance? We can help! We work closely with your insurance to take the.

Lowest Jumbo Refi Rates

See today's year jumbo mortgage rates and compare all your options before applying for a loan. Current jumbo mortgage rates are % for a 30 year fixed rate loan, % for a 15 year fixed loan and % for a 5/1 adjustable rate mortgage (ARM) ; Jumbo refinance rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. Pennymac knows jumbo loans and can guide you through the process to find your best option. Jumbo mortgage eligibility requirements include: Great credit –. Presently, the lowest fixed interest rate on a fixed reverse mortgage is % (% APR), and variable rates are as low as % with a margin. See what Citizens offers for fixed rate and variable rate jumbo mortgages. We also offer interest only payments for those who qualify. View today's jumbo loan rates for a wide variety of products, and find the best lender for your needs. Save thousands of dollars over the life of your loan. Jumbo Mortgage Rates** ; 5/1 ARM Jumbo · %, %, % · % ; 30 Year Fixed Rate Jumbo · %, %, % · % ; 15 Year Fixed Rate Jumbo · A jumbo loan is a mortgage for higher loan amounts. Get information about jumbo mortgages and view loan rates in your area. See today's year jumbo mortgage rates and compare all your options before applying for a loan. Current jumbo mortgage rates are % for a 30 year fixed rate loan, % for a 15 year fixed loan and % for a 5/1 adjustable rate mortgage (ARM) ; Jumbo refinance rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. Pennymac knows jumbo loans and can guide you through the process to find your best option. Jumbo mortgage eligibility requirements include: Great credit –. Presently, the lowest fixed interest rate on a fixed reverse mortgage is % (% APR), and variable rates are as low as % with a margin. See what Citizens offers for fixed rate and variable rate jumbo mortgages. We also offer interest only payments for those who qualify. View today's jumbo loan rates for a wide variety of products, and find the best lender for your needs. Save thousands of dollars over the life of your loan. Jumbo Mortgage Rates** ; 5/1 ARM Jumbo · %, %, % · % ; 30 Year Fixed Rate Jumbo · %, %, % · % ; 15 Year Fixed Rate Jumbo · A jumbo loan is a mortgage for higher loan amounts. Get information about jumbo mortgages and view loan rates in your area.

Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %.

Which bank is best for refinancing? Based on our lender data, JPMorgan Chase Bank offers the best refinance rates overall. However, the best bank for your. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. High closing costs – You should be prepared to pay from 2% to 6% of the principal balance of your refinance loan upfront when you refinance a jumbo loan. While. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Refinance rates · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Jumbo Fixed Rate Payment Example: As an example, a fixed rate Jumbo loan of $, for 30 years at % interest and % APR will have a monthly payment. Ally's jumbo loan rates start at %, which is among the best in the industry. Plus, Ally will match a competitor's price if you send a loan estimate dated. The jumbo rates quoted above are for loan amounts above $, up to $1,, Rates displayed are “as low as” and effective 09/13/ for purchase and. Utilize the Lowest JUMBO Rates in Houston, TX and Chicago & Aurora, IL to Your Benefit · At their core, Jumbo fixed-rate loans are a type of mortgage loans that. Prequalify to see how much you might be able to borrow, start your application or explore year jumbo refinance rates and features. Not what you're looking. For example, you take out a $, mortgage with 20% down and at an interest rate of %. With a year jumbo loan, you'll pay $, in interest. In. The best jumbo loan lenders · Best overall jumbo lender: Ally Bank · Best for low-credit jumbo loans: Veterans United · Best for high loan amounts: Chase Bank. What and where are people finding the best interest only jumbo rates? I see Schwab has some options through Rocket (% with a point off for relationship. Get current Jumbo mortgage rates at loanDepot, a direct lender with today's low rates on Jumbo loans to refinance or buy a home. Customized mortgage rates ; 7/6 ARM, % (%), $1, ; year fixed, % (%), $ ; year fixed, % (%), $1, ; year fixed, %. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year. If you're looking to buy a home in a higher price range, you'll most likely need a special type of mortgage. With a Jumbo Loan from PNC, you can finance up to. Jumbo mortgages typically are for larger loan amounts not covered by conforming loan limits. We offer flexible loan terms, including fixed-rate. Today's Jumbo Mortgage Rates ; LoanFlight Lending, LLC. NMLS # · % · $1, /mo · % ; New American Funding, LLC. NMLS # · % · $1, /mo.

Where To Buy Netspend Prepaid Card

The original Netspend reloadable prepaid Visa debit card with reload locations. Choose Pay As You Go or low monthly fee with deposit. When it comes to NetSpend Prepaid Cards, WalletHub is your one stop solution. Read Reviews, Compare Latest Offers, Ask Questions or Get Customer Service. Netspend | A Better Way to Bank - Get your Netspend Visa Prepaid Debit Card now! 1 Netspend Prepaid Customers: Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction. The Netspend Visa Prepaid Card may be used everywhere Visa debit cards are accepted. The Netspend Prepaid Mastercard may be used everywhere Debit Mastercard is. With Direct Deposit, you can get paid faster than a paper check. No late fees or interest charges because this is not a credit card. Use the Netspend Mobile App. Netspend | A Better Way to Bank - Get your Netspend Prepaid Mastercard now! You can even choose a photo of yourself to help merchants know it's you. Get A Western Union NetSpend Prepaid Card. Fees for money transfers. Reloadable prepaid cards are available at select Western Union Agent locations nationwide. On hccf.ru, click Find Locations. The original Netspend reloadable prepaid Visa debit card with reload locations. Choose Pay As You Go or low monthly fee with deposit. When it comes to NetSpend Prepaid Cards, WalletHub is your one stop solution. Read Reviews, Compare Latest Offers, Ask Questions or Get Customer Service. Netspend | A Better Way to Bank - Get your Netspend Visa Prepaid Debit Card now! 1 Netspend Prepaid Customers: Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction. The Netspend Visa Prepaid Card may be used everywhere Visa debit cards are accepted. The Netspend Prepaid Mastercard may be used everywhere Debit Mastercard is. With Direct Deposit, you can get paid faster than a paper check. No late fees or interest charges because this is not a credit card. Use the Netspend Mobile App. Netspend | A Better Way to Bank - Get your Netspend Prepaid Mastercard now! You can even choose a photo of yourself to help merchants know it's you. Get A Western Union NetSpend Prepaid Card. Fees for money transfers. Reloadable prepaid cards are available at select Western Union Agent locations nationwide. On hccf.ru, click Find Locations.

The funds can be loaded onto the prepaid card either online or by calling the customer service. The user will provide the pack's reload number to load the funds. The Netspend Visa Prepaid Card is issued by Pathward, National Association, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Ouro Global Inc. is a. When it comes to NetSpend Prepaid Cards, WalletHub is your one stop solution. Read Reviews, Compare Latest Offers, Ask Questions or Get Customer Service. Shop for NetSpend Visa Reloadable Prepaid Debit Card VL $$ () at Fry's Food Stores. Find quality gift cards products to add to your Shopping List. Shop for NetSpend Visa Reloadable Prepaid Debit Card VL $$ () at Kroger. Find quality gift cards products to add to your Shopping List or order. Shop for NetSpend Visa Reloadable Prepaid Debit Card VL $$ () at Pick 'n Save. Find quality gift cards products to add to your Shopping List or. Shop for Reloadable Debit Cards at Walmart and save. Visa $ Gift Card (plus $ Purchase Fee) · out of 5 stars. (17,). $ ; $ Mastercard Gift Card (plus $ Purchase Fee) · out of 5. purchase and load with cash. Load $$ This is not a giftcard. Reload. Change the way you pay. No credit check (Important Information About Procedures. Shop for NetSpend Visa Reloadable Prepaid Debit Card VL $$ () at QFC. Find quality gift cards products to add to your Shopping List or order. Netspend. Earn $2 DG Cash when you purchase and register a Netspend Via Prepaid Card. Offer Valid: 6/30/24 - 12/31/ Subject to card activation and ID. Find these cards at your local Walgreens · Scarlet TM Bank Account and. Mastercard® Debit Card · Green Dot Visa® Debit Cards · GO2bank Visa® Debit Card · Serve. Reload your card at a retailer near you. 3 reloadable Netspend Prepaid Cards displayed in their packaging. Example of a Netspend Reload location on a digital. The Netspend Prepaid Mastercard is issued by Pathward, National Association, Member FDIC, pursuant to a license by Mastercard International Incorporated. Ouro. Shop for NetSpend Visa Reloadable Prepaid Debit Card VL $$ () at King Soopers. Find quality gift cards products to add to your Shopping List or. Shop for NetSpend Visa Reloadable Prepaid Debit Card VL $$ () at Fred Meyer. Find quality gift cards products to add to your Shopping List or. Get your stimulus payment faster than a paper check in the mail. Direct Deposit your stimulus payment onto a Netspend Visa Prepaid Card. No late fees or. The Netspend Visa Prepaid Card is issued by Pathward, National Association and Republic Bank & Trust Company, pursuant to a license from Visa U.S.A. Inc. The. There is no cost to order and activate a Netspend card. Once you activate the card, you may choose from our selection of fee plans. To view the fee plans and. Select Direct Deposit on your tax form (or select the direct deposit option if filing online) to receive your refund on your Netspend Debit Account when filing.

Mortgage Back End Ratio

Lenders look at two ratios. The front-end ratio is the percentage of monthly before-tax earnings that are spent on house payments (including principal, interest. Standards and guidelines vary, most lenders like to see a DTI below 35─36% but some mortgage lenders allow up to 43─45% DTI, with some FHA-insured loans. The back-end ratio can be calculated by summing the borrower's total monthly debt expenses and dividing it by their monthly gross income. Back-End Ratio: Considers all debt payments, including mortgage expenses, credit cards and loans, in comparison to your monthly income. Lenders prefer a front-. Back-End Ratio: this ratio is the percentage of income for paying your reoccurring debt. These debt payments could include credit card bills, car loans, student. The back-end DTI ratio is the percentage of a borrower's monthly income that would go toward all the borrower's debt obligations. The back end ratio compares what portion of your income is needed to cover all of your monthly debts. These debts include housing expenses in addition to loans. Front-end ratio: Sometimes referred to as the “housing ratio,” your front-end ratio refers to what part of your income goes toward housing costs. · Back-end. Back-end ratio. Your back-end DTI includes your mortgage payments plus all of your other monthly debt obligations, including car loans and student loans. Lenders look at two ratios. The front-end ratio is the percentage of monthly before-tax earnings that are spent on house payments (including principal, interest. Standards and guidelines vary, most lenders like to see a DTI below 35─36% but some mortgage lenders allow up to 43─45% DTI, with some FHA-insured loans. The back-end ratio can be calculated by summing the borrower's total monthly debt expenses and dividing it by their monthly gross income. Back-End Ratio: Considers all debt payments, including mortgage expenses, credit cards and loans, in comparison to your monthly income. Lenders prefer a front-. Back-End Ratio: this ratio is the percentage of income for paying your reoccurring debt. These debt payments could include credit card bills, car loans, student. The back-end DTI ratio is the percentage of a borrower's monthly income that would go toward all the borrower's debt obligations. The back end ratio compares what portion of your income is needed to cover all of your monthly debts. These debts include housing expenses in addition to loans. Front-end ratio: Sometimes referred to as the “housing ratio,” your front-end ratio refers to what part of your income goes toward housing costs. · Back-end. Back-end ratio. Your back-end DTI includes your mortgage payments plus all of your other monthly debt obligations, including car loans and student loans.

Back-end ratio is the percentage of income that goes toward paying all recurring, minimum monthly debt payments, in addition to the monthly mortgage costs. Lenders vary in the specific DTI ratios they are looking for, but in general, lenders want to see a maximum front-end ratio somewhere between 28% and 31% and a. Use this worksheet to figure your debt to income ratio. Generally speaking, a debt ratio greater than or equal to 40% indicates you are not a good credit risk. Back-end DTI. This takes into consideration the amount of your income used to pay all monthly debt including your current rent or mortgage, plus credit cards. The Back-End Ratio aka the “DTI” (debt-to-income ratio) calculates the amount of gross income that goes toward paying ALL monthly debt payments including. The back-end ratio shows how much of a person's monthly income paying off debts represents. Examples of debts include mortgages, student loans, car loans, and. Front-end debt ratio, sometimes called mortgage-to-income ratio in the context of home-buying, is computed by dividing total monthly housing costs by monthly. Front End vs Back End DTI. This calculator shows your frontend & backend debt to income ratios. Historically lenders have preferred the front end ratio to be. The first of these ratios is the housing-to-expense ratio, also known as the front-end ratio. This ratio will tell you how much of your gross -- or pre-tax According to the Federal Deposit Insurance Corp., lenders typically want the front-end ratio to be no more than 25% to 28% of your monthly gross income. The. The back-end DTI consists of your monthly housing payment plus all other monthly debt, such as your car payment or credit card balance. Here's how to calculate. The front-end ratio is calculated by dividing an individual's anticipated monthly mortgage payment by his/her monthly gross income. The mortgage payment. What is a debt-to-income ratio? · Front-end DTI: This includes just your housing-related debts (what your expected new mortgage payment, taxes, insurance, etc. We want your front-end ratio to be no more than 28 percent, while your back-end ratio (which includes credit card payments and other debts) should not exceed Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit. How To Calculate. Lenders typically seek a back-end DTI below 43% for conventional mortgages. This percentage is considered a conservative threshold. The back-end-ratio is used by lenders to determine what percentage of your monthly gross income will go toward all of your monthly debt obligations. Essentially. For conventional home loans, lenders like to see a front-end ratio of 28% or lower. Then, the back-end ratio should be no higher than 36%. A front-end DTI calculates how much of a person's gross income is going towards housing costs. Front-End DTI = (Housing Expenses ÷ Gross Monthly Income) x

Dataops Jobs

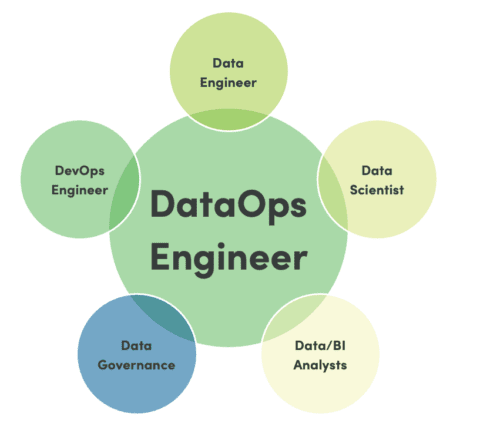

Browse 11 Dataops Jobs in Web3 in Sep with salaries from $50k/year to $k/year at companies like ParagonsDAO, Stargaze Finance, and Tokemak. DataOps Analytics Manager · Technology is constantly changing, so we need a quick and innovative manager to partner with the technology team and take our. 73 Dataops jobs available on hccf.ru Apply to Engineer, Data Engineer, Senior Engineer and more! What is the pay outlook for Engineering? Engineering jobs are in high demand with workers receiving generous compensation packages and bonuses. Engineering. All candidates, including those with criminal histories will be considered for employment. However, a background check adjudicated consistently with the FDIC. DataOps is a better way to develop and deliver analytics. It applies Agile development, DevOps and lean manufacturing principles to data analytics. Perficient is seeking an experienced AWS DataOps Engineer to design, implement, and maintain robust cloud-based solutions and big data workflows.. Duties & Responsibilities · Develops and continuously improves DataOps platform. · Develops and maintains common tools and libraries. · Evaluates new. 77 Dataops Engineer job openings in the United States as of July , with employment types broken down into 8% Work From Home, 86% Full Time, and 6% Contract. Browse 11 Dataops Jobs in Web3 in Sep with salaries from $50k/year to $k/year at companies like ParagonsDAO, Stargaze Finance, and Tokemak. DataOps Analytics Manager · Technology is constantly changing, so we need a quick and innovative manager to partner with the technology team and take our. 73 Dataops jobs available on hccf.ru Apply to Engineer, Data Engineer, Senior Engineer and more! What is the pay outlook for Engineering? Engineering jobs are in high demand with workers receiving generous compensation packages and bonuses. Engineering. All candidates, including those with criminal histories will be considered for employment. However, a background check adjudicated consistently with the FDIC. DataOps is a better way to develop and deliver analytics. It applies Agile development, DevOps and lean manufacturing principles to data analytics. Perficient is seeking an experienced AWS DataOps Engineer to design, implement, and maintain robust cloud-based solutions and big data workflows.. Duties & Responsibilities · Develops and continuously improves DataOps platform. · Develops and maintains common tools and libraries. · Evaluates new. 77 Dataops Engineer job openings in the United States as of July , with employment types broken down into 8% Work From Home, 86% Full Time, and 6% Contract.

Remote DataOps jobs. Discover the best remote and work from home DataOps jobs at top remote companies. Job title or skill search. DataOps. Remove DataOps. Browse 6+ Remote DataOps Jobs in August at companies like Lightspeed Commerce, Revelator and Knowbe4 with salaries from $/year to $/year. DataOps builds upon the principles and practices of DevOps, a software development methodology that emphasizes collaboration, automation, and continuous. Capgemini Jobs. capgemini Logo. Mobile capgemini Logo. What. job title, keywords. Where. city, state, country. Home View All Jobs (). Job Information. Join the hccf.ru team today! We're looking for colleagues on our Sales, Marketing, Engineering, Product, and Support teams. Discover 6 Dataops Crypto Jobs in July The latest job published 5 months ago is Senior Data Ops Analyst at FOX Tech. Today's top 37 Dataops Engineer jobs in Bengaluru, Karnataka, India. Leverage your professional network, and get hired. New Dataops Engineer jobs added. HUMAN is hiring for a Data Ops Analyst in New York, NY, USA. Find more details about the job and how to apply at Built In NYC. Data Analytics Dataops Engineer jobs in Cupertino, CA hiring now on The Muse. Explore DataOps for Snowflake today live SaaS platform has grown exponentially, with more than 1 million pipelines runs, more than 10 million jobs. Browse DATAOPS jobs ($$31/hr) from companies with openings that are hiring now. Find job postings near you and 1-click apply! Experfy gives you direct access to hiring teams at Fortune s and fast-growing companies that are looking for the Top DataOps Architects. Apply To Dataops Jobs On hccf.ru, #1 Job Portal In India. Explore Dataops Job Openings In Your Desired Locations Now! Explore DataOps for Snowflake today live SaaS platform has grown exponentially, with more than 1 million pipelines runs, more than 10 million jobs. Search Dataops jobs from over 15+ jobs listing platforms. Apply for DataOps Engineer job with New Balance in Brighton, Massachusetts, United States of America. Technology at New Balance. hccf.ru is hiring on Otta. See employee endorsements, gender diversity, salaries, benefits and more. A job defines the pipeline to run and the execution engine that runs the pipeline. The SDK enables you to interact with jobs on the DataOps Platform. dataops jobs in remote · Chief of Staff - Idera DataOps · DataOps Engineer II · Senior DataOps Engineer I · Principal Data Engineer · DataOps Engineer. Search the latest DataOps Engineer jobs hiring in September on hccf.ru Updated daily.

Is Hazard Insurance Required

Hazard insurance is part of a homeowners insurance policy; it's not a separate type of insurance coverage. You need to have a certain level of hazard insurance. The maximum allowable deductible for all required property insurance perils for one-to four-unit properties is 5% of the property insurance coverage amount. Mortgage lenders usually require proof that you have a certain amount of hazard insurance before issuing a loan. Because hazard insurance is part of your. The maximum allowable deductible for all required property insurance perils for one-to four-unit properties is 5% of the property insurance coverage amount. Yes, most lenders will require you to purchase homeowners insurance as a condition of approving your mortgage. Lenders also usually require you to continue. PART I - HOMEOWNER/FIRE INSURANCE. Your lender and FHA/VA have basic, minimum hazard insurance requirements related to your home mortgage, which are described. Mortgage lenders usually require proof that you have a certain amount of hazard insurance before issuing a loan. · As unlikely as disasters are, they can and do. If you have a mortgage or loan on your home, you may not have a say in whether or not you need hazard insurance. Most mortgage companies require homeowners to. However, in most cases, those who have a financial interest in your home—such as a mortgage or home equity loan holder—will require that it be insured. And, for. Hazard insurance is part of a homeowners insurance policy; it's not a separate type of insurance coverage. You need to have a certain level of hazard insurance. The maximum allowable deductible for all required property insurance perils for one-to four-unit properties is 5% of the property insurance coverage amount. Mortgage lenders usually require proof that you have a certain amount of hazard insurance before issuing a loan. Because hazard insurance is part of your. The maximum allowable deductible for all required property insurance perils for one-to four-unit properties is 5% of the property insurance coverage amount. Yes, most lenders will require you to purchase homeowners insurance as a condition of approving your mortgage. Lenders also usually require you to continue. PART I - HOMEOWNER/FIRE INSURANCE. Your lender and FHA/VA have basic, minimum hazard insurance requirements related to your home mortgage, which are described. Mortgage lenders usually require proof that you have a certain amount of hazard insurance before issuing a loan. · As unlikely as disasters are, they can and do. If you have a mortgage or loan on your home, you may not have a say in whether or not you need hazard insurance. Most mortgage companies require homeowners to. However, in most cases, those who have a financial interest in your home—such as a mortgage or home equity loan holder—will require that it be insured. And, for.

Lenders don't often require those additional catastrophe, flood, or other natural disaster coverages for the purpose of a mortgage loan, but the homeowner. Those hoping to qualify for a mortgage will likely need to buy hazard insurance with their homeowners insurance. Since the value of your home is tied to the. Reviews will help you understand whether a homeowners insurance policy is required and if so when it would be required by whom. Read on to learn more. Most lenders require you to maintain a standard homeowners insurance policy. If you reside in a high-risk area, your lender may require you to purchase. If you have a mortgage loan, you will be required to have hazard insurance coverage as part of your homeowners insurance policy. Hazard insurance protects. If you have a home and a mortgage, your lender will require you to have homeowner insurance. If you don't have a mortgage, it's a good idea to protect your. Find your state and learn about homeowners insurance coverage options and available discounts with Progressive. In other words, it's the dwelling coverage portion of your home insurance policy. Banks and other mortgage lenders require hazard insurance when you buy your. Reviews will help you understand whether a homeowners insurance policy is required and if so when it would be required by whom. Read on to learn more. There is no national guideline for whether a lender should require hazard insurance or not, and specific types of insurance (including flood or fire insurance). The reason hazard insurance is a common term is actually because of lenders. Your mortgage lender may require homeowners insurance with hazard at minimum before. When do I need to get homeowners insurance? It's a good idea to start shopping for homeowners insurance as soon as you sign a contract to buy a home. This. Yes, you need both. The homeowner's insurance protects YOU in case someone is injured on your property, as well as insuring your house against. Most lenders require you to maintain a standard homeowners insurance policy. If you reside in a high-risk area, your lender may require you to purchase. As evidence of continuous hazard insurance coverage that complies with the loan contract's requirements, a servicer may require a copy of the borrower's hazard. Hazard insurance is specifically required by mortgage companies. Lenders want homeowners to have coverage on the house so it can be repaired if there's a. An important part of the home-buying process is knowing what kinds of coverage you will need. One of the policies you may be required to purchase is hazard. Typically, hazard insurance covers your property's structure if there should be a natural disaster, like a hurricane, a nor'easter, or a forest fire. Most. Your mortgage lender will require that you have hazard insurance. It's the minimum coverage that they insist you carry because it protects the asset that. Hazard insurance is mandatory if you're financing your home. But it's one of the best ways to reduce your financial risk, even if your home is paid in full.

3 4 5 6 7