hccf.ru Learn

Learn

Whatsapp Owned By Facebook

Facebook, American online social network service that is part of the company Meta Platforms. Facebook was founded in by Mark Zuckerberg. Meta-owned WhatsApp is set to introduce a significant update to its Facebook wordmark. Log in. . WE News English's post. WE News. The company owns and operates Facebook, Instagram, Threads, and WhatsApp, among other products and services. Meta ranks among the largest American. Mark Zuckerberg is the founder, chairman and CEO of Meta, which he originally founded as Facebook in WhatsApp Help CenterWorkplace Help CenterMeta Quest. Yes. WhatsApp Inc., based in Mountain View, California, was acquired by Facebook in February for approximately US$ billion. The Cloud API allows you to send and receive messages to and from customers using cloud-based servers owned by Meta. Facebook for Developers Community. What companies does Facebook own? · Zenbe and Beluga. In , Facebook purchased the messaging startup Zenbe for an undisclosed amount of money. · Instagram. For more info, please refer to hccf.ru Creating. You can't perform this operation on this. The growth we're seeing here in the US has especially been a bright spot. WhatsApp now serves more than million monthly actives in the US, and we're seeing. Facebook, American online social network service that is part of the company Meta Platforms. Facebook was founded in by Mark Zuckerberg. Meta-owned WhatsApp is set to introduce a significant update to its Facebook wordmark. Log in. . WE News English's post. WE News. The company owns and operates Facebook, Instagram, Threads, and WhatsApp, among other products and services. Meta ranks among the largest American. Mark Zuckerberg is the founder, chairman and CEO of Meta, which he originally founded as Facebook in WhatsApp Help CenterWorkplace Help CenterMeta Quest. Yes. WhatsApp Inc., based in Mountain View, California, was acquired by Facebook in February for approximately US$ billion. The Cloud API allows you to send and receive messages to and from customers using cloud-based servers owned by Meta. Facebook for Developers Community. What companies does Facebook own? · Zenbe and Beluga. In , Facebook purchased the messaging startup Zenbe for an undisclosed amount of money. · Instagram. For more info, please refer to hccf.ru Creating. You can't perform this operation on this. The growth we're seeing here in the US has especially been a bright spot. WhatsApp now serves more than million monthly actives in the US, and we're seeing.

Presently, the Facebook (now Meta) company owns WhatsApp. In this, people can send text messages as well as voice notes, images, and GPS locations through their. Facebook-owned WhatsApp hits 1 billion users. Facebook-owned WhatsApp hits 1 billion users. PM Tue 2 Feb, Share: Facebook-owned smartphone messaging service WhatsApp has hit the. Facebook-owned mobile messaging service WhatsApp has reached the milestone of one-billion users, with 42 billion messages being exchanged daily. Key Takeaways. Facebook purchased WhatsApp in Facebook's bid price was astronomical, even for Silicon Valley, with a bid at $16 billion. What Companies Are Owned by Facebook? · Instagram ($1 billion) · WhatsApp ($19 billion) · Oculus VR ($2 billion) · com (undisclosed sum) · LiveRail ($ million). The company owns and operates Facebook, Instagram, Threads, and WhatsApp, among other products and services. Meta ranks among the largest American. The Cloud API allows you to send and receive messages to and from customers using cloud-based servers owned by Meta. Facebook for Developers Community. If Facebook is selling our data, then whatsapp and instagram are also not reliable, right? Because they are also owned by Facebook. A WhatsApp Business Account (WABA) lets your business use the WhatsApp Business Platform to communicate directly with your customers. My company is requiring WhatsApp (facebook owned) for communication amongst management. So we have been using facebook messenger to. COMPANIES OWNED BY META PLATFORMS INC. · 1)Facebook · 2)Instagram · 3)Whatsapp · 4)Messenger. Use WhatsApp Messenger to stay in touch with friends and family. WhatsApp is free and offers simple, secure, reliable messaging and calling, available on. WhatsApp currently shares certain categories of information with its parent company, Meta, and the Meta Companies. If you use WhatsApp Messenger. The. Facebook (Meta) owned WhatsApp has changed its footer to showcase that it is now a Meta-owned app. Learn more about what companies Meta owns and operates WhatsApp LLC and WhatsApp Ireland Limited (hccf.ru Mark Zuckerberg is the founder, chairman and CEO of Meta, which he originally founded as Facebook in WhatsApp Help CenterWorkplace Help CenterMeta Quest. In a corporate culture fostered by large venture capital funds, startups compete to become the next big billion-dollar disrupter, like Uber or WhatsApp. Too. A trio of apps owned by Facebook - Facebook, WhatsApp and Instagram. A closeup of apps on a smartphone screen. Facebook (Meta) owned WhatsApp has changed its footer to showcase that it is now a Meta-owned app. Use WhatsApp Messenger to stay in touch with friends and family. WhatsApp is free and offers simple, secure, reliable messaging and calling, available on.

Funeral Insurance Usa

Burial insurance is a type of life insurance policy that can be used to cover funeral expenses. Learn more to find out if it's worth it and how it works. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. Burial insurance covers the cost of your funeral and/or cremation expenses after you pass away. It can also be used at the beneficiary's discretion to pay off. American Income Life provides affordable life insurance and supplemental health benefits to working families in the United States, Canada, and New Zealand. Average Funeral Expense Coverage. Coverage can range anywhere between $5, and $20,, with most policies falling around $10, for both men and women. When. $10, Whole Life insurance can help families deal with grief, rather than worry about burial expenses. This State Farm policy pays a fixed $10, death. They price-shop funeral services, review contracts, and help surviving family members save hundreds — even thousands — of dollars on funeral costs. Fast Claims. Companies that offer approved funeral and pre-need insurance policies · Funeral Directors Life Insurance Company: · Great Western Insurance Company. Final expense whole life insurance helps loved ones cover funeral and other final expenses. Learn how final expense insurance works and get a quote. Burial insurance is a type of life insurance policy that can be used to cover funeral expenses. Learn more to find out if it's worth it and how it works. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. Burial insurance covers the cost of your funeral and/or cremation expenses after you pass away. It can also be used at the beneficiary's discretion to pay off. American Income Life provides affordable life insurance and supplemental health benefits to working families in the United States, Canada, and New Zealand. Average Funeral Expense Coverage. Coverage can range anywhere between $5, and $20,, with most policies falling around $10, for both men and women. When. $10, Whole Life insurance can help families deal with grief, rather than worry about burial expenses. This State Farm policy pays a fixed $10, death. They price-shop funeral services, review contracts, and help surviving family members save hundreds — even thousands — of dollars on funeral costs. Fast Claims. Companies that offer approved funeral and pre-need insurance policies · Funeral Directors Life Insurance Company: · Great Western Insurance Company. Final expense whole life insurance helps loved ones cover funeral and other final expenses. Learn how final expense insurance works and get a quote.

We provide life insurance, disability insurance, dental insurance, and other benefits that help protect people and inspire their well-being. 4 Best Burial Insurance Companies · Best for High Coverage: Mutual of Omaha · Best for Same-Day Coverage: SBLI Life Insurance · Best for Guaranteed Approval. Burial insurance is a basic type of life insurance that is used to pay for funeral services and merchandise costs. Find out about military and veterans life insurance and survivor benefits. Ask hccf.ru a question at. USAGOV1 (). Find us on social. State Farm: Best for customer satisfaction · AARP/New York Life: Best for low consumer complaints · American Family: Best for bundling · Ethos: Best for instant. Burial insurance, also known as funeral or final expense insurance, is a type of whole life insurance policy designed to cover your funeral, burial, and other. For more than years, Allianz Life Insurance Company of North America (Allianz) has been helping Americans like you prepare for their financial future. Final expense is a smaller permanent life insurance policy typically intended to help older adults cover funeral costs and other end-of-life expenses. If you (or your spouse) own life insurance polices or have other burial Visit hccf.ru Dignity Memorial® providers offer pre-need insurance through American Memorial Life Insurance. This allows you to pre-plan a service and pay monthly premiums. Our Funeral Preplanning Insurance allows individuals to select funeral products and services and fund their chosen funeral plan with life insurance. Funeral and Final Expense coverage simplified. · Call USA Family Protection · Answer simple health questions. No medical exam necessary* · If eligible, get. How much does a final expense policy cost? · That depends on your situation. · Final expense policies typically cover anywhere from $2, to $50, · The. “Burial insurance” usually refers to a whole life insurance policy with a death benefit of from $5, to $25, As its nickname implies, people buy this. How much does a final expense policy cost? · That depends on your situation. · Final expense policies typically cover anywhere from $2, to $50, · The. Final expense insurance, also referred to as burial insurance, covers end-of-life expenses including funeral arrangements and any remaining medical or legal. Funeral expense life insurance pays for your burial or cremation costs when you pass away. Because many people are unaware that funerals can cost thousands of. Burial insurance. Another option is burial insurance, also known as funeral insurance or final expense insurance. Burial insurance allows for flexibility. Final Expense Life Insurance can provide additional layers of financial protection to families of seniors, retired individuals, or individuals with underlying. Burial insurance, sometimes referred to as final expense insurance, is a life insurance policy designed to cover funeral costs and other final expenses like.

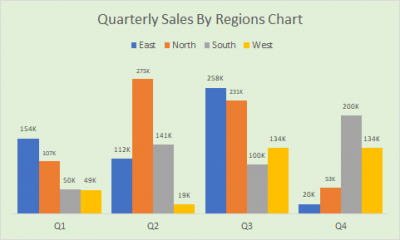

Region Stock Price

On Monday 08/26/ the closing price of the Regions Financial Corp. share was $ on BTT. Compared to the opening price on Monday 08/26/ on BTT of $ Regions Financial Price to Book Value: for Aug. 23, · Price to Book Value Chart · Historical Price to Book Value Data · Price to Book Ratio Definition. Price, $, Volume, 1,, Change, , % Change, %. Today's Open, $, Previous Close, $ Intraday High, $, Intraday Low, $ Based on the average yearly growth of the Regions Financial stock in the last 10 years, the RF stock forecast for the beginning of next year is $ Using. Region Group's current share price is $ This Relative to today's opening stock price, the RGN stock price is unchanged. Regions Financial (RF) · (Real Time Quote from BATS) · Quote Overview · Research Reports for RF · News for RF · Price and EPS Surprise Chart · Billion Dollar Secret. Discover real-time Regions Financial Corporation Common Stock (RF) stock prices, quotes, historical data, news, and Insights for informed trading and. Find the latest Region Group (hccf.ru) stock quote, history, news and other vital information to help you with your stock trading and investing. Real time Regions Financial (RF) stock price quote, stock graph, news & analysis. On Monday 08/26/ the closing price of the Regions Financial Corp. share was $ on BTT. Compared to the opening price on Monday 08/26/ on BTT of $ Regions Financial Price to Book Value: for Aug. 23, · Price to Book Value Chart · Historical Price to Book Value Data · Price to Book Ratio Definition. Price, $, Volume, 1,, Change, , % Change, %. Today's Open, $, Previous Close, $ Intraday High, $, Intraday Low, $ Based on the average yearly growth of the Regions Financial stock in the last 10 years, the RF stock forecast for the beginning of next year is $ Using. Region Group's current share price is $ This Relative to today's opening stock price, the RGN stock price is unchanged. Regions Financial (RF) · (Real Time Quote from BATS) · Quote Overview · Research Reports for RF · News for RF · Price and EPS Surprise Chart · Billion Dollar Secret. Discover real-time Regions Financial Corporation Common Stock (RF) stock prices, quotes, historical data, news, and Insights for informed trading and. Find the latest Region Group (hccf.ru) stock quote, history, news and other vital information to help you with your stock trading and investing. Real time Regions Financial (RF) stock price quote, stock graph, news & analysis.

Region Re | SCPStock Price | Live Quote | Historical Chart ; GPT, , , % ; HomeCo Daily Needs, , , %. Stock analysis for Region RE Ltd (RGN:ASE) including stock price, stock chart, company news, key statistics, fundamentals and company profile. RF's current price target is $ Learn why top analysts are making this stock forecast for Regions Financial at MarketBeat. Year End Stock Prices ; , ; , ; , ; , ; , Regions Financial Corp RF:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/28/24 · 52 Week Low Chart Stock Quote ; Open. $ ; Change. -$ (%) ; Day's Range. $ - $ ; Week Range. $ - $ ; Volume. M. Track Regions Financial Corp. (RF) Stock Price, Quote, latest community messages, chart, news and other stock related information. See the latest Regions Financial Corp stock price (RF:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Find out the current price target and stock forecast for Regions Financial (RF). Research Regions Financial's (NYSE:RF) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Stock analysis for Regions Financial Corp (RF:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Regions Financial Corp. operates as a bank holding company. It provides traditional commercial, retail and mortgage banking services, as well as other. Investor Email Alerts. Sign up to receive Annual Reports, Quarterly Results, Stock Quotes and more in your inbox. Sign up for alerts. Chart Stock Quote ; Open. $ ; Change. -$ (%) ; Day's Range. $ - $ ; Week Range. $ - $ ; Volume. M. Regional Banks Stocks. Companies in the regional bank sector accept cash and other Stock Price. $0 - $+. Stocks Under $ Returns. % - 50%. All. Regions Financial Corporation Common Stock (RF) Historical Quotes. 1M 6M YTD 1Y 5Y MAX Download historical data. Liquidation Preference: $ ; Recent Market Price: $ ; Discount to Liquidation Preference: (More Preferreds Trading at a Discount»), $ (%). Liquidation Preference: $ ; Recent Market Price: $ ; Discount to Liquidation Preference: (More Preferreds Trading at a Discount»), $ (%). All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at. The all-time high Regions Financial stock closing price was on October 13, · The Regions Financial week high stock price is , which is %.

Can I Use 401k To Buy A House Without Penalty

Yes, early withdrawals from your (k) are possible, but they generally incur a 10% penalty and are subject to income tax. Can I borrow against my k? Yes. At this point, you're considered retirement eligible by the IRS and can withdraw from your IRA penalty free. Can I Use My (k) To Buy A House? Yes, if you use a (k) loan instead of taking a distribution — and pay it back on time — you won't pay any penalties. If I. What are the Rules & Penalties for Using (k) Funds to Buy a House? ; Must be repaid with interest in a certain period of time — usually 5 years. · Qualified. Yes, if you use a (k) loan instead of taking a distribution — and pay it back on time — you won't pay any penalties. If I. In fact, it is possible to use both your k and individual retirement accounts (IRAs) to invest in real estate. And contrary to popular belief, it is possible. When you withdraw money from your (k), you have to pay income taxes on the amount you withdraw and you may also have to pay a 10% early withdrawal penalty if. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. Why do you think this is a good idea? Mortgage rates are extremely low, and the penalties you will pay to access your k will cost you more. Yes, early withdrawals from your (k) are possible, but they generally incur a 10% penalty and are subject to income tax. Can I borrow against my k? Yes. At this point, you're considered retirement eligible by the IRS and can withdraw from your IRA penalty free. Can I Use My (k) To Buy A House? Yes, if you use a (k) loan instead of taking a distribution — and pay it back on time — you won't pay any penalties. If I. What are the Rules & Penalties for Using (k) Funds to Buy a House? ; Must be repaid with interest in a certain period of time — usually 5 years. · Qualified. Yes, if you use a (k) loan instead of taking a distribution — and pay it back on time — you won't pay any penalties. If I. In fact, it is possible to use both your k and individual retirement accounts (IRAs) to invest in real estate. And contrary to popular belief, it is possible. When you withdraw money from your (k), you have to pay income taxes on the amount you withdraw and you may also have to pay a 10% early withdrawal penalty if. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. Why do you think this is a good idea? Mortgage rates are extremely low, and the penalties you will pay to access your k will cost you more.

Generally, with either plan, if you are under age 59 ½ and take money out of the fund, you will incur a 10% early withdrawal penalty (plus whatever penalty your. You may be subject to a 10% penalty for early withdrawals from your k. You can use your k funds to purchase a property without having to sell other. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. No taxes or penalties. Since it's a primary purchase, most Ks will let you do a maximum year repayment term, so it's not painful when the. You can withdraw funds or borrow from your (k) to use as a down payment on a home. Choosing either route has major drawbacks, such as an early withdrawal. You can withdraw funds or borrow from your (k) to use as a down payment on a home. Choosing either route has major drawbacks, such as an early withdrawal. The only way to withdraw funds early from a (k) is to claim a hardship withdrawal. The IRS generally allows the funds withdrawal as a hardship if you claim. Can I Use My (k) to Buy a House? Yes, you can technically use your (k) to buy a house but withdrawing that money comes at a high cost. Those same (k). Can you use k to buy a house without penalty? You will not be penalized if you take a loan for your k rather than a withdrawal because you're paying the. Using your k to buy a house is generally not recommended, as there are significant penalties and taxes associated with withdrawing funds from your k. If you withdraw the money from your (k) before you hit 59 1/2 years, you'll be required to pay a 10% early withdrawal penalty. However, there are some. Typically if you withdraw money out of your Traditional IRA prior to age 59 you have to pay ordinary income tax and a 10% early withdrawal penalty on the. When a (k) loan is repaid, it avoids classification as a distribution. This means that a loan isn't subject to early withdrawal penalties or income taxes on. Borrowing from Your k without Penalty You may be wondering, how can I use my k to buy a house? There are two possible options: k withdrawals and k. (k) loans are also not subject to income tax like an early withdrawal is. However, keep in mind that if you do not repay your loan within the given time. Well, since you are no longer working, then you are free to take a pre-mature distribution from your k. You would need to pay income taxes. You can withdraw without penalty if you are 59 and a half or older, or if you qualify for a hardship withdrawal. With the withdrawal, you won't have to repay. As it turns out, employees may draw from their (k)s without penalty if the money is used for a qualifying purchase. Those with a (k) can essentially use. Raiding your (k) for a home down payment might make sense in some scenarios, but it generally has a lot of drawbacks. Your (k) can be used toward a down payment on a home, but that doesn't mean it's the best solution. Know what could happen before touching retirement.

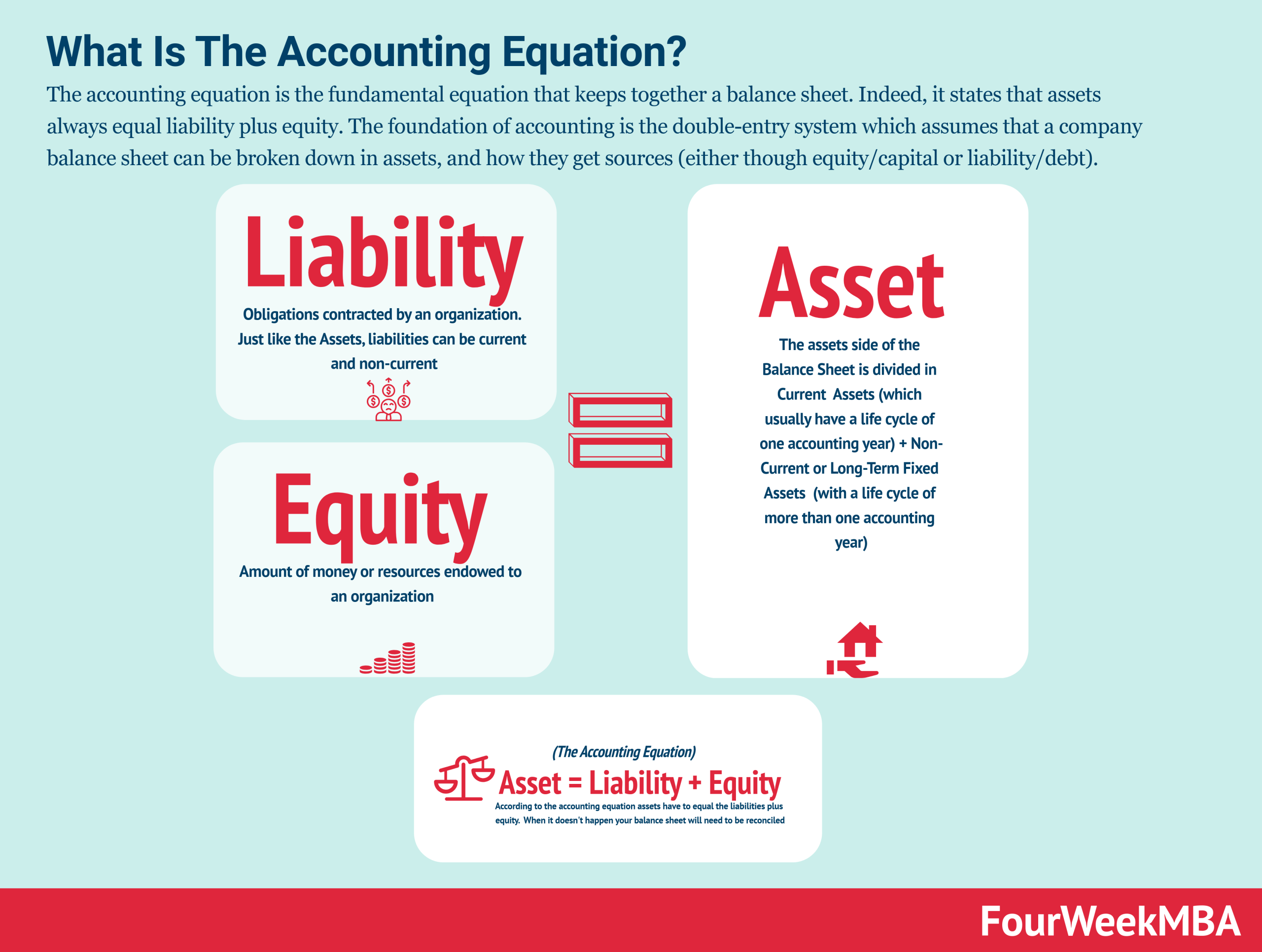

What Is The Basic Accounting Equation

The basic accounting equation is, Assets = Liabilities + Capital. It means that all the monetary value of all assets of a firm are equal to the total claims. The basic accounting equation formula is Assets = Liabilities + Equity. This equation states that the total value of an entity's assets must equal the total. The basic accounting equation, also called the balance sheet equation, represents the relationship between the assets, liabilities, and owner's equity of a. The expanded equation is used to compare a company's assets with greater granularity than provided by the basic equation. What Is the Basic Accounting Equation? The basic accounting equation balances the following three elements: Assets, Liabilities, and Owner's Equity. Combining liabilities and equity shows how the company's assets are financed. This basic equation offers a way for businesses to ensure that their financial. These are the building blocks of the basic accounting equation. The accounting equation is: ASSETS = LIABILITIES + EQUITY. For Example. For Example: If Assets = $50, and Liabilities = $18,, what is the amount of Equity? Using the Accounting Equation, plug in the. The accounting equation states that the value of a company's assets is equal to the sum of the company's liabilities and equity. The basic accounting equation is, Assets = Liabilities + Capital. It means that all the monetary value of all assets of a firm are equal to the total claims. The basic accounting equation formula is Assets = Liabilities + Equity. This equation states that the total value of an entity's assets must equal the total. The basic accounting equation, also called the balance sheet equation, represents the relationship between the assets, liabilities, and owner's equity of a. The expanded equation is used to compare a company's assets with greater granularity than provided by the basic equation. What Is the Basic Accounting Equation? The basic accounting equation balances the following three elements: Assets, Liabilities, and Owner's Equity. Combining liabilities and equity shows how the company's assets are financed. This basic equation offers a way for businesses to ensure that their financial. These are the building blocks of the basic accounting equation. The accounting equation is: ASSETS = LIABILITIES + EQUITY. For Example. For Example: If Assets = $50, and Liabilities = $18,, what is the amount of Equity? Using the Accounting Equation, plug in the. The accounting equation states that the value of a company's assets is equal to the sum of the company's liabilities and equity.

Assets = total Liabilities + Equity. For each transaction, the total debits equal the total credits. The fundamental accounting equation. Accounting Equation is a fundamental concept in financial accounting that helps businesses understand their financial position. THE FUNDAMENTAL ACCOUNTING EQUATION The four financial statements are all based on a mathematical equation, which states that the dollar value of a. The accounting equation states that a company's total assets are equal to the sum of its liabilities and its shareholders' equity. The Basic Accounting Equation, also known as the Balance Sheet Equation, states that Assets equal Liabilities plus Equity. This equation reflects the. The basic accounting equation, also called the balance sheet equation, represents the relationship between the assets, liabilities, and owner's equity of a. The basic accounting equation formula shows the relationship between assets, liabilities, and owner's equity. It is written as Assets = Liabilities + Owner's. The fundamental accounting equation, also called the balance sheet equation, is the foundation for the double-entry bookkeeping system and the cornerstone. Assets = Liabilities + Equity. In order to understand its importance, it's best to see it in action in a simple form. Assets are what a company owns. For. Owner's Equity (the difference between assets and liabilities). The accounting equation (or basic accounting equation) offers us a simple way to understand how. It offers a quick, no-frills answer to keeping your assets versus liabilities in balance. Here's the formula: Assets = Liabilities + Equity. What is the accounting equation? Accounting equation is a track of whether the company's assets equal its liabilities plus the owner's or shareholder's equity. The accounting equation states that total assets is equal to total liabilities plus capital. This lesson presented the basic accounting equation and how it. The expanded equation is used to compare a company's assets with greater granularity than provided by the basic equation. What Is the Basic Accounting Equation? From the owner's point of view, owner's equity = assets - liabilities. This equation looks more natural, but often we aren't interested in the owner's point of. The accounting equation of a sole proprietorship is assets = liabilities + owner's equity. Assets = Liabilities + Shareholder's Equity The fundamental accounting equation is debatably the foundation of all accounting, specifically the double-entry. The basic accounting equation is: Assets = Liabilities + Owner's equity. Therefore, If liabilities plus owner's equity is equal to $,, then the total. The Accounting Equation says that Assets are equal to Liabilities plus Equity. Assets = Liabilities + Equity This is a core principle of Accounting. The accounting equation is Assets = Liabilities + Stockholders' Equity. The resources owned by a business are its assets. The rights or claims to the assets are.

2 3 4 5 6